The Next Wave

Digital and social have established themselves as the media industry’s new frontier, creating massive disruption in their wake. The resulting upheaval is impacting media entities, client choices and advertising spends – and this is possibly the best thing that has happened to a fossilised industry in years.

The convergence of digital media and technology, under way since the dawn of the internet, is changing the rules of the global media industry. Distinctions between old and new media are fading and most media is – or will be – digital in the near future. Mobile devices, already the preferred medium and internet platform for many people, will continue to proliferate. Digital technology has given more people the power to create media and to distribute it around the world. Amateur journalists, photographers and filmmakers can now aspire to a global audience. Local entertainers can achieve international stardom. For an audience in this digital era, all content can be accessed anywhere, anytime.

HH Sayyid Faisal Bin Turki Al Said

Director General of Marketing and Media, Ithraa

Oman’s media landscape is also undergoing a fundamental shift, which can be summed up in two words: digital first. This shift is changing the dynamics of newspapers, magazines and radio; it is rewriting the rules of advertising and forcing clients and agencies to make new choices. Aware of the migration of media consumers (and customers) to digital and social platforms, progressive companies in the market, across all sectors, are shifting their advertising spends towards these entities.

“There has been an evolution in the way we have been handling the media,” says His Highness Sayyid Faisal Bin Turki Al Said, the Director General of Marketing and Media at Ithraa. “Earlier, we were very dependent on conventional media, like newspapers but in the last three to five years, social media has become a key driver of how people communicate and this has made us look at more popular channels.”

Ithraa is tasked with the job of investment promotion and export development in Oman. As a part of its brief, its aim is to enrich knowledge about the country and the opportunities that it offers by providing information and services.

“Earlier, we were very dependent on conventional media like newspapers, but in the last three to five years, social media has become a key driver of how people communicate” – HH Sayyid Faisal Bin Turki Al Said

His Excellency Ibrahim bin Ahmed Al Kindi

Chief Executive Officer, Oman Establishment for Press, Publication and Advertising

“Compared to the cost of print media, the softer side of media, which primarily includes social, is much more cost-effective and it has a bigger reach. One can control the pace at which information can be disseminated, one can tweak, retrieve or reply to it and this is not easy in traditional media,” adds HH Sayyid Faisal Bin Turk Al Said.

However, His Excellency Ibrahim Bin Ahmed Al Kindi, the CEO of Oman Establishment for Press, Publication and Advertising, says many media houses have been forced to upgrade their technologies to keep up with the country’s tech-savvy youth.

“Most media institutions are being forced to follow technological trends as the new generation follows them,” he says. “We have social media platforms, websites and applications for our newspapers like Oman Daily and Oman Observer and we are working on upgrading them.”

“Most media institutions are being forced to follow technological trends as the new generation follows them” – HE Ibrahim Bin Ahmed Al Kindi

Wisam Al Said, the Senior Manager of Corporate Communications at Bank Nizwa, says: “We realise that digital media is more cost-effective and has a wider reach. There have been campaigns for which we have not used any print media at all.”

Realising the advantages of digital media, such as measurability and reach, National Bank of Oman (NBO), increased advertising spend on digital from single digits in 2014 to double digits in 2015 and has also launched its own digital platforms. Meanwhile, Towell Auto Group has allocated 40 per cent of its advertising spend to digital compared to a minuscule amount three years ago.

“We started giving more weightage to digital without compromising on print as an essential part of our strategy” – Hussain Al Lawati

Hussain Al Lawati

Managing Director, Omasco

For a company like Oman Marketing and Services Company (Omasco), whose entire marketing effort revolves around customer orientation, ignoring nearly 50 per cent of smartphone carrying young Omanis is no longer a choice.

The company has incorporated social media as a critical part of its media strategy.

“We started giving more weightage to digital without compromising on print as an essential part of our strategy,” says Hussain Al Lawati, Omasco’s Managing Director.

New frontier

Although everyone agrees that it’s essential to have a digital presence, there is little clarity on what it means or the best way to use it. The primary issue is a misunderstanding of the word digital. Digital is not media, but a technological option. So while technology is an important part of the creative product, it is no substitute for ideas. The imperative to engage unobtrusively with Generation Next is forcing companies back to the drawing board. In a world where online banner advertisements are construed as an intrusion in a customer’s experience, marketers are learning a thing or two about native advertising, brand stories and narratives.

Roula Khatib

Head of Advertising, TOP

“There has been a growth in storytelling from branded content. A company’s ability to connect with the audience on digital and social would come only from quality content and not from being focused on one’s brand,” says Roula Khatib, the Head of Advertising at TOP. Ramzy Halaby, the CEO and co-founder of TOP, adds: “There is a lot of clutter on social media when it comes to content and so unless you are offering unique, relevant content and storytelling that touches the lives of customers, your content will not be shared.”

Sharing of content, so that a brand’s message gains traction, has become an essential part of the marketing mix. The biggest determinant of whether a post, picture or video will be shared is quality and not the frequency of content. Engaging with influencers and the right kind of network is another key to enhancing a brand’s shareability. Influencers are people who have quality followers and can create a movement, generate attention and set a trend. As a result, these influencers are the first ones to be targeted in any outreach activity. Companies in the Middle East are picking up on this and applying best practices.

“A company’s ability to connect with the audience on digital and social would come only from quality content and not from being focused on one’s brand.” – Roula Khatib

In turn, the metrics of measuring social media is also changing. A couple of years ago, brands were working on getting likes and a fan base. A year ago, marketers insisted on engagement with their target audiences. Today, shareability is the new benchmark. Says Paul Ross, the Marketing Manager of Wattayah Motors: “We are creating opportunities for content creation, never-experienced-before moments and Instagrammable experiences. We’ve found that brand experience has become a powerful way to connect with consumers in ways that are meaningful to them and inspires them to share their experience right at the moment of inspiration.”

“From an online perspective, visual marketing with videos, animations, infographics and even gifs is rapidly gaining traction.” – Mohammad Al Farei

Rajesh Raman

Vice President, The Holding Group

Taking a cue from the Harry Potter fictional newspaper, Daily Prophet, Facebook made technical changes to its platform, making it easier for people to post videos directly on the site instead of sharing it from elsewhere. A year ago, only 25 per cent of all videos were posted directly to Facebook, but these days, 70 per cent of videos are uploaded directly, cutting out video sharing sites like YouTube.

Facebook’s initiative points to a new reality – visuals, both still and moving, have more appeal on social media. As attention spans get shorter and demand increases for engaging content, companies are focusing on visual marketing as a growing component of their marketing mix. Mohammad Al Farei, the Managing Director of Zeenah Group, says: “From an online perspective, visual marketing with videos, animations, infographics and even gifs is rapidly gaining traction. We are seeing a big appetite for these from clients and also publicly produced visual content.”

The mobile invasion

If 2014 was a benchmark year for digital and social media around the world, then it has to be said that 2015-16 is shaping up to be even more remarkable in terms of growth and the way in which we stay connected. According to We Are Social, the global social media agency, mobile is increasingly dominating the digital world thanks to cheaper handsets and more affordable data connections.

Mohammad Al Farei

Managing Director, Zeenah Group

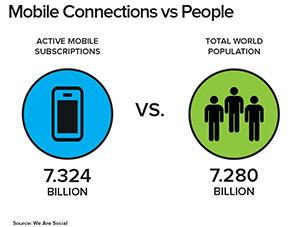

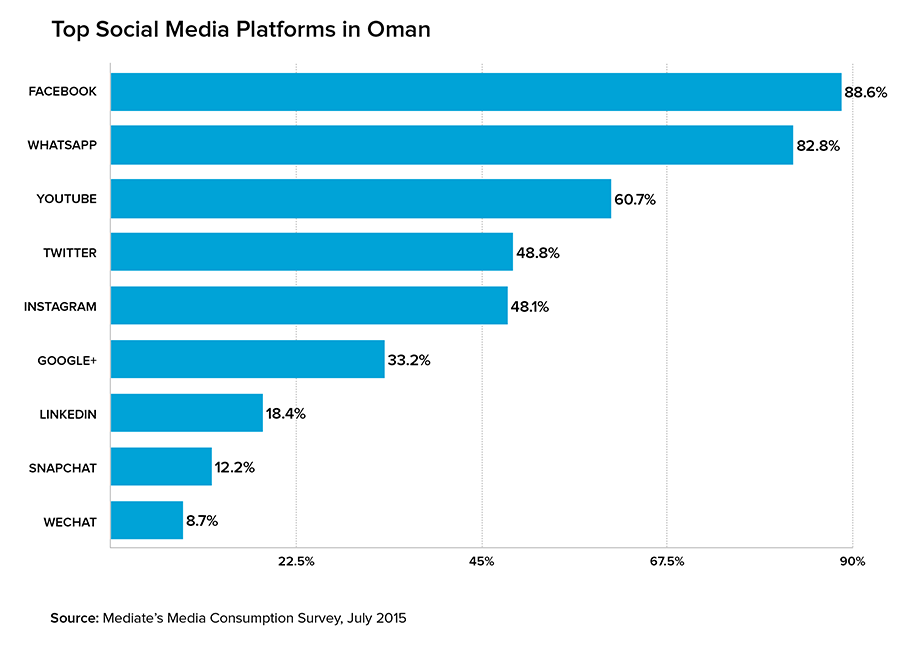

“With mobile-oriented services like WhatsApp, WeChat and Facebook Messenger achieving the top social media ranking spots in some of the world’s biggest economies, it’s clear that much of our digital behaviour is now converging around mobile devices,” We Are Social said in its annual Digital, Social and Mobile in 2015 report.

“Based on the trends within this data, we expect that mobile will help to push internet penetration beyond 50 per cent of the world’s population during mid to late 2016. Before that, though, we expect to see social media penetration reach one-third of the world’s population – likely by the end of 2015 – with new users in developing nations accounting for almost all of this growth.”

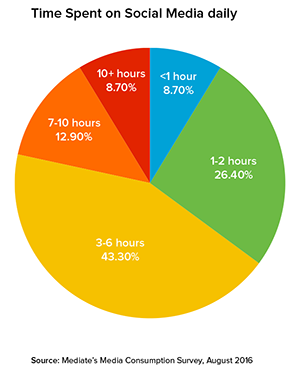

The explosive numbers recorded globally in the past year for social and digital have reached landmark proportions, with, for instance, social media users worldwide already exceeding 2 billion in August 2014. Meanwhile, global penetration of mobile phones passed 50 per cent last September, internet users around the world edged above 3 billion in November and the number of active mobile connections now outnumbers the total world population.

“It’s clear that much of our digital behaviour is now converging around mobile devices.” – We Are Social

Much of the forecast growth in social and digital over the next 18 months or so will emanate from emerging countries, including the Middle East, where active internet users have already hit 87 million, or 36 per cent of the total population of 238 million.

The number of active mobile connections in the Middle East has also surpassed its total population at 294 million connections versus 238 million people. This is on track with the global trend of mobile dominance, but with a 124 per cent penetration, it is way above the world average of 51 per cent. But when it comes to active mobile social accounts, the Middle East has hit 35 million, or a penetration of just 15 per cent.

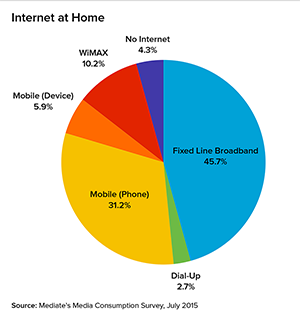

Oman’s digital landscape betrays a few unique characteristics, setting it apart from some of the developed countries. The biggest differentiator is the high usage of smartphones by consumers. “Oman completely skipped the desktop revolution and went straight to mobile,” says Rajesh Raman, the Vice President of The Holding Group. “Personal computer penetration was not that great, but mobile penetration is over 100 per cent. Everything that people are doing is focused on mobile media, compared to the desktop.”

Recent figures released by the National Centre for Statistics and Information (NCSI) confirm the explosion in the smartphone market in the Sultanate, with the number of mobile phone lines rising 2.3 per cent in May 2015 to hit 6.3 million. This is against a total population of just over 4.1 million.

Suresh Nair

Head of Marketing and Communication, Towell Auto Group

Mobile gives users an ability to customise their media selection and this is great news for marketers. For example, if there was a brand that aimed to attract luxury goods buyers, it could target mobile devices that are priced at a certain price point and above. Says Suresh Nair, the Head of Marketing and Communication at Towell Auto Group: “This year, our objective is to execute the strategy of ‘mobile first’ in our digital communication. This means to convert all our customer engagement channels starting from the website to the mobile app to be mobile friendly.” With more than 87 per cent of the traffic to Towell Auto Group’s digital channels coming through mobile platforms, it was important for the company to make this change to ensure good customer experience and to optimise its channels to mobile devices.

The distinct preference for smartphones holds a lot of promise for mobile advertising in the Sultanate. “Adults are still increasing the amount of time they spend on digital media and almost all of that extra time is spent on mobile devices. And if you look at the amount of time people spend on various forms of media to the percentage of advertising spend dedicated to each type of media, mobile has significant room to grow,” says Paul Ross of Wattayah Motors.

“Recent figures confirm the explosion in the smartphone market in the Sultanate, with the number of mobile phone lines rising 2.3 per cent in May 2015 to hit 6.3 million.”

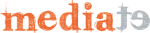

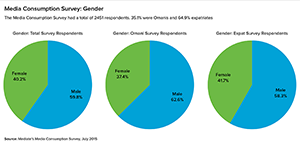

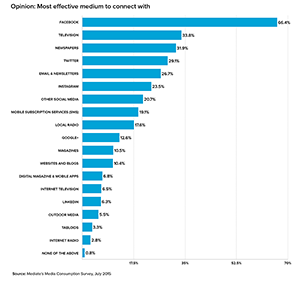

Mediate carried out a Media Consumption Survey in Oman in both English and Arabic. With a sample size of 2,451, the survey corroborated the growing strength of mobile in Oman. For example, it found that:

- Smartphones have emerged as the preferred medium for consuming media, with 88.6 per cent of respondents saying they owned a smartphone compared with 65.8 per cent who said they owned a laptop and 37.7 per cent who used a tablet.

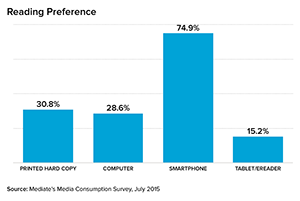

- 74.9 per cent of the survey’s respondents said they preferred using their smartphones to access news and information, while just 30.8 per cent said they read the news via printed hard copy.

- But the most popular platform accessed via smartphones is social media, with a massive 81.5 per cent of respondents saying they used their smartphones primarily for social networking, such as Facebook (72.6 per cent) and WhatsApp (65.8 per cent).

The big divide

Najeeb Mohamed

General Manager, FP7 Oman

While there are few who disagree with the power or salience of digital media, advertising spends on it averages in the single digits, with print publications still commanding close or over half of all advertising spends. The disconnect between the audience and advertiser remains a perplexing puzzle. Says Suresh Nair of Towell Auto Group, “There could be several reasons for this gap, like a lack of understanding of the digital media by advertisers in terms of ROI, low internet penetration, lack of a long-term commitment to the digital medium to name a few. I also believe that while a new media has emerged, it does not mean that traditional mediums have lost their relevance. TV, radio and print, apart from Out of Home (OOH), mediums still have relevance only that these including digital need to be used in context of the marketing objective and target audience that one is trying to reach out to.”

This may probably have something to do with the immaturity of the digital and social media market. “We still do not have hard data or analytics in Oman on the digital side to prove or disprove a claim,” says Rajesh Raman of The Holding Group. “There are absolute numbers, but there is no psychographic data or profile of people.” Mohammad Al Farei of Zeenah Group adds: “The social media landscape is growing increasingly cluttered, especially over the last 12 to 24 months and there are many more specialised and niche interest social media platforms to choose from.”

Najeeb Mohamed, the General Manager of FP7 Oman, says: “Newspapers offer a one-sided conversation, but digital is more interactive. So while there are clients who are excited about social media, they do not want to hear anything negative.” The fact that digital platforms are used largely by youngsters, who may have less of a purchasing power compared to an older demographic may be another deterrent. Anything that involves consumers like retail and food products can be better targeted by using digital platforms as it is interactive and one can get instant feedback. On the other hand, digital does not lend itself very well to industrial products. “Those products which P&G calls the moment of truth, those are the products that lend themselves naturally to digital and social. So while digital and social are growing within a certain specific audience, I have my doubts whether they will be all pervasive,” he adds.

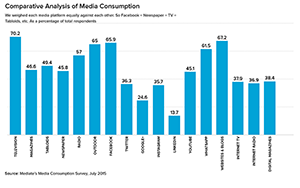

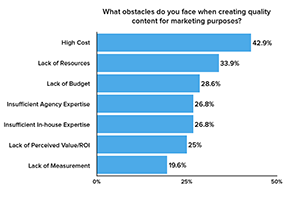

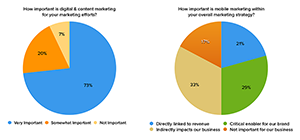

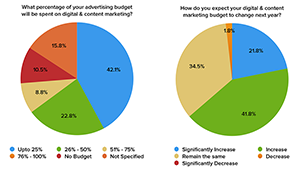

While Mediate’s 2015-16 Marketing Survey found that digital and mobile marketing spends will increase significantly over the next 12 months, this year tells a slightly different story, with newspapers still garnering the majority of ads. For example, the Marketing Survey found:

- 80.7 per cent of respondents continue to use newspapers as their medium of choice to promote their brands, products and services.

- Facebook, however, is hot on the heels of newspapers, with 70.1 per cent saying they also used the world’s most popular social media platform to promote their brands and products.

- 41.8 per cent of the survey’s respondents also said their content marketing budgets would increase next year, while 21.8 per cent said it would significantly increase and 34.5 per cent said it would remain the same.

Paul Ross

Marketing Manager, Wattayah Motors

However, early converts like banks, automobile, telecom and real estate players have shown a definite interest in the new media. A number of brands understand the attractiveness of spending on digital and are shifting budgets from traditional to digital.

Moreover, there is an effort by companies to move towards integrated campaigns with digital at the core. Says Ramzy Halaby of TOP: “There is a shift in spends. As a benchmark, we are seeing that media consumption on digital is very high, compared to spends, while in the case of traditional media consumption, it is very low compared to the spend. So the potential for spending on digital media is very high and it can only go up.” TOP’s Roula Khatib adds: “Clients ask us, ‘Where should I spend my budget?’ And we tell them to spend it where their customers are spending their time and this differs from client to brands.” If the touchstone of advertising is to target one’s audience, it is should be a no-brainer for marketers in Oman to make the logical choice.

Primacy of print

Alpana Roy

Executive Vice President, UMS

The coming of age of digital and social media poses the biggest threat to print publications – newspapers and magazines in Oman. Although newspapers have had a large share of the advertising pie in the past, there is a real danger that they may lose a significant part of their revenues to their digital counterparts in the coming years. Staring down the barrel, print media has little choice but to change. “We are completely aware that if we have to build a long-term sustenance in our core business of informing, engaging and entertaining readers, then we have to ensure that we are available 24/7 to them through different channels,” says Alpana Roy, the Executive Vice President at UMS.

As silos between print and digital disappear, leading media houses are working on getting a share of the overall media space. This is being achieved by changing channels of delivery, such as having a website and reaching readers through mobile phones, WhatsApp applications and video delivery. Secondly, they are increasingly using the power of the consumer by being interactive on social media platforms such as Facebook and Twitter to promote their brands. This is a key focus area for most of them.

“If we have to build a long-term sustenance in our core business of informing, engaging and entertaining readers, then we have to ensure that we are available 24/7 to them through different channels” – Alpana Roy

Ahmed Al Zadjali

Chief Executive Officer, Muscat Media Group

“We have changed the name of our company from Muscat Press and Publishing to Muscat Media Group,” says Ahmed Al Zadjali, the CEO of Muscat Media Group. “So we are no longer a publishing house, but a multimedia group. We are digital, print, radio, TV and can approach our customers through all these mediums.” Going by statistics, the group has already had some success in this direction. The Times of Oman’s website has been ranked at number 6 among all sites in Oman by Alexa. Al Shabiba, the group’s Arabic newspaper, is at number 21.

Newspapers are also trying to strike a balance between print and digital by allowing advertisers to insert a QR code or an augmented reality link in print ads. These, in turn, take readers to the client’s website or a video message. Despite print media’s efforts to go digital, clients still seem to be sceptical of their efforts. “The traditional media knows that there is a shift that is happening and they are making efforts, but it is not structured and serious. Though their intentions may be good, they are not there as yet,” says Omasco’s Hussain Al Lawati.

Wisam Al Said, of Bank Nizwa, adds: “A lot of printed publications need to move online, some have but most have not. We do not understand the statistics of the print media in terms of their target audience, reach or print run, but we still use print and press as it is important.”

Ramzi Halaby

Co-founder and Business Development Director, The Online Project (TOP)

Media entities, in turn, blame agencies and clients for the sorry state of affairs. “We have seen a rapid increase in our income on the digital media side in 2015 and it now makes up around three to five per cent of our total advertising revenue,” says HE Ibrahim Bin Ahmed Al Kindi, of Oman Establishment for Press, Publication and Advertising.“Overall, it is not a significant amount and the change will not happen till agencies change their mindset. We are building a platform for tomorrow, but agencies need to change and start allocating bigger budgets to digital and social. Most people working in agencies are from the old school and so it is difficult for them to relate to something new.” Alpana Roy of UMS adds: “There is a definite shift towards digital advertising, but it is still not attractive compared to the overall marcom budgets.”

Addressing other challenges in print media, HE Ibrahim Bin Ahmed Al Kindi says: “Unfortunately, there is no real data regarding reach and readership of newspapers in Oman and this is a big problem. Reading habits are very low, making things more challenging.” However, Alpana Roy says: “In Oman, the challenge is the size of the market and the business dynamics that make it a deterrent for publishers and medium owners to adopt the international standards for measurement and ROI.”

A few clients, however, are making efforts to infuse an element of accountability in the print media in Oman. “When we launch a product, we try and measure our sale before and after a print campaign to give us some benchmark,” says Dheeraj Ahluwalia, the Head of Marketing, Retail and Private Banking, at National Bank of Oman (NBO). “That is correlation not causality. So we are trying to get more scientific, but it is an ongoing journey.”

“We are building a platform for tomorrow, but agencies need to change and start allocating bigger budgets to digital and social.” – HE Ibrahim Bin Ahmed Al Kindi

HE Ibrahim Bin Ahmed Al Kindi cites a New York Times study that found that print advertising still made up two thirds of the budget of total advertising spends in the Middle East against one third spent on digital. His Excellency also cites another report on the Middle East media, which revealed that print media is in a good position for the next 25 years in terms of content dissemination and advertising.

Mohammad Al Farei of the Zeenah Group echoes this view. “Despite the ease and topicality of social media, there is still a healthy market for print within the Sultanate,” he says. “Various studies have proven, world over, that readers spend infinitely more time with newspapers than their digital counterparts. In short, print is still a very tactile experience for people and that’s something that is hard to replicate digitally. The other advantage for print is the extended shelf life of a newspaper or a magazine, which tend to stay around for days or weeks as opposed to mere seconds for an online impression.”

Looking ahead, Rajesh Raman of The Holding Group says: “Media houses need to focus on share of attention, instead of the share of budget. The challenge is to increase the amount of time that the consumer spends with a media group and its offerings in a day. For standalone products, it is going to be an uphill battle. The choice is clear – media houses need to reinvent or perish.”

Listen on

Over the past eight years, since private commercial radio was allowed in the Sultanate, there has been a steady growth in this medium. The number of private radio stations has risen from one or two to around nine stations now. The growth of the medium has brought in international players like Monte Carlo FM and BBC News Service to the market. It has also attracted a high level of interest from listeners and advertisers. Overall, commercial radio has firmly established itself as a viable business option for media companies and agencies.

Darren Shortt

Group Operations Manager, Hi FM and Hala FM

“We have stepped up our radio budget considerably this year,” says Dheeraj Ahluwalia of NBO. “We found that while reading habits are not strong, Omanis are very auditory in nature and things that they hear resonates with them much more.” Wisam Al Said of Bank Nizwa: “Radio is one of the top mediums for us and we are looking at tapping into it.”

Darren Shortt, the Group Operations Manager at Hi FM and Hala FM, says: “We have constantly had a flow of commercials since we launched in 2008. We have seen dips, a recession in 2009 and cuts to budgets recently due to low oil prices, but with Ramadan and our new additional coverage, there has been an increase in advertising.” Nadim Attieh, the Station Manager for Al Wisal and Merge 104.8, says: “Our revenue and market share has grown year on year. Our product is getting more mature and couple of years down the line, we would have to create something that will maintain our growth and keep it appealing for our listeners.”

“We have seen dips, a recession in 2009 and cuts to budgets recently due to low oil prices, but with Ramadan and our new additional coverage, there has been an increase in advertising” –Darren Shortt

Worldwide, radio has reached a point of saturation and while analogue radio is stagnating, online listenership is thriving. While Oman is far from that as of now, the increasing popularity of digital and social media presents an opportunity for radio stations in Oman.

“If people download your application, then they are buying into your brand and want you to be a part of their online experience and this is growing,” says Darren Shortt of Hi FM. “In the Sultanate, online has boomed in the last two years and the growth of Google adverts is at par with what is found internationally or probably more.” Says Nadim Attieh: “At Al Wisal and Merge 104.8, we have taken advantage of social media and increased our listener and follower base as it helps us to connect with our audience even when they are not tuned into our stations.” Fatma Al Lawati, the PR and Communications Manager at Al Wisal and Merge, adds: “Once we put out any information on Facebook and Twitter, which listeners might have missed out on Al Wisal, they tune in to the station and spread the word. Social media is therefore very important for brand building. Al Wisal has 220,000 followers on Twitter.”

With its unique topography and geography, Oman doesn’t lend itself very well to conventional radio listening indoors. “Oman has a very difficult topography and for FM stations to reach its audience is a geographical challenge, as one needs to go behind every mountain and hill to get a signal, which is both a financial and technical challenge,” says Nadim Attieh. “While our operating costs have gone up, advertising rates have not risen commensurately.”

Radio stations are coming up with out-of-the-box solutions to make it easier and more attractive for clients to advertise on radio. “Unfortunately, most of our clients ask for more, but not for things that are different,” says Nadim Attieh. “I am a big believer that on radio less is more and more is less. It is better to have five quality spots in a day than 20 cheesy spots, so it is more about quality.”

Darren Shortt adds: “We are developing in such a way that it becomes more affordable to advertise. Radio is an expensive medium, however, it is effective. The entry point in radio is quite high. We are developing a system where we can split the commercial advertising, so that a person owning a shop in Salalah is not buying 30 seconds of time of a person in Buraimi. We are doing relevant content and commercials for each of our regions.” The localisation makes it more affordable. Campaigns on radio can be bought from RO1,000 upwards, and we can customise according to someone’s budget.

However, Nadim Attieh says: “In terms of advertising, there is a big shift from print to digital and not so much from radio to digital. Social media poses a threat to all traditional media compared to radio. Digital cannot compete with radio.” Darren Shortt sums it up, saying: “People may consume music in different ways, but radio will always have a role in popularising music.”

Out of home

Drive on any road in Oman and it is difficult to miss street furniture, billboards and hoardings. JCDecaux and SABCO Media are playing a major part in transforming the urban landscape of Oman. “The dynamic for the outdoor media is quite good,” says Sebastien Soares, the Managing Director of JCDecaux Oman.

Sebastien Soares

Managing Director, JCDecaux Oman

The varying types of OOH being brought in by SABCO Media and JCDecaux is helping to change clients’ mindsets and communication strategies. It is also bringing about a new quality consciousness among local companies. For example, BTME, which manages Al Madina’s unipoles and megacoms in the interiors of Oman, has upgraded its boards to ensure that they are backlit, there is little down time and that prints are of good quality. “Outdoor is a good media because you have no choice but to look at it as it is in your line of vision,” says Shirish Gupte, the Director of BTME. “Driving is a default in Oman, picking up a newspaper is a choice.” Out-of-home (OOH) advertising is used worldwide to attract people’s attention before they shop, as research shows that OOH has a strong influence on purchase consideration.

Dheeraj Ahluwalia of NBO corroborates this. “The media mix has changed for us. Previously, we thought that if you took space in the leading dailies with a certain frequency then it would help build your brand, but our brand track studies found that outdoors is a bit more effective media to build brand awareness and recall than print and radio.”

Outdoor as a media has a number of factors – such as a geographically spread out country, new roads being constructed, proliferation of malls and new buildings – helping its fast-paced growth. Bank Nizwa’s Wisam Al Said says: “We really believe in the power of outdoors. As a media it is effective as Muscat and other cities in Oman are not as cluttered as some other parts of the world, and people see and notice it. Mall branding is another thing that is powerful and we have used it to our advantage. Outdoor, including mall branding, makes up 80 per cent of our advertising budget.”

“We thought that if you took space in the leading dailies with a certain frequency then it would help build your brand, but our brand track studies found that outdoors is a bit more effective media to build brand awareness and recall than print and radio.” – Dheeraj Ahluwalia

As of now banks, telecom, automobiles and food and beverage companies are the biggest users of outdoor advertising. Following their lead, a number of other sectors are looking at increasing their spending. Previously, there was a hesitation to spend on OOH, but that has disappeared. and everybody is now talking about social and digital media. The problem with this is that companies are still unclear about what they can do with digital – the market is disorganised in terms of this, while clients are remain hesitant.

Despite more acceptance, challenges persist in the field of outdoors. The lack of agencies that have a good understanding of outdoors is forcing companies to go directly to clients, convincing people to advertise remains another hurdle. Companies like SABCO Media and JCDecaux have moved from the traditional way of selling one mupie or signage to network selling and this remains an imponderable, as clients are largely fixated on specific locations.

“Outdoor is a good media because you have no choice but to look at it as it is in your line of vision” – Shirish Gupte

Shirish Gupte

Director, BTME

Comparisons with digital are another test as this medium can be measured with analytics, while the impact of an outdoor campaign is more subjective. That said, thousands of people may remember an advertisement as part of an outdoor campaign, but may or may not click on a digital ad, let alone remember it.

There is also an impression that outdoor does not lend itself well to all kinds of advertising and it can be a tool for a secondary campaign, but not the primary media. Shirish Gupte of BTME counters this perception. “For a brand, outdoors can be a primary medium, for a campaign it might be secondary. If you have a very verbose message, then no one is going to look at it, but if you have a striking visual or message, then people will be forced to look at it. What hits the mind immediately is the brand.”

Despite the roadblocks, experts agree on the growth potential of outdoor media in Oman, saying they are positive about the development of outdoors in Oman as it is a young market.

Reputation management

Public relations, or PR, is a relatively new addition to the market in Oman. However, this burgeoning industry has come a long way in a short period of time. A variety of PR agencies of differing sizes and capabilities have emerged in recent years. While some PR operators are little more than glorified typing services sitting at the back of an advertising agency, there are others who offer a wide range of corporate communications services on par with major worldwide PR firms.

“The [PR] sector is in a growth stage – experiencing constant evolution and progression towards a more professional and creative environment.” – James Macleod

James Macleod

General Manager, Zeenah PR

“As time passes, we are seeing more public and private sector organisations gaining a better understanding of the value of reputation management and accordingly choosing to be represented professionally in front of the media,” says James Macleod, the General Manager of Zeenah PR. “From a staffing perspective, young Omanis are increasingly coming to the realisation that the PR sector offers a rewarding and stimulating career path.

The sector is in a growth stage – experiencing constant evolution and progression towards a more professional and creative environment. Presently, the baseline awareness of PR is relatively limited, revolving primarily around the drafting and issuing of announcements and stories to media, aka ‘press releases’. These press releases, however, make up only a small component of what is a much larger corporate communications function.

“An effective communications strategy that incorporates PR as a core function has the ability to deliver messaging in a way that advertising and marketing cannot duplicate. Further, the role of PR is not limited to only written communications. We are also finding that clients are increasingly aligning their social media efforts with their PR strategy, showing a growing understanding that good PR is very much about generating a conversation, not a one-sided bombardment of information.”

“As time passes, we are seeing more public and private sector organisations gaining a better understanding of the value of reputation management.” – James Macleod

As the awareness of the value of PR grows, so are budget allocations. PR and social media pose a challenge to traditional advertising and marketing avenues, indicating a powerful shift in understanding and acceptance of the medium.

It’s showtime

Sukaina Haider

Managing Director, Suza Events

The limited reach of traditional media, is encouraging companies to look at events as a brand building tool. Events can attract anywhere between 100 to upwards of 4,000 people, giving advertisers an instant connect with their target audience. Says Sukaina Haider, Managing Director, Suza Events, “People nowadays don’t read newspapers and magazines. Given this changing scenario, events, radio and social media are emerging as strong advertising mediums.” A number of company’s have started allocating a certain amount of their marcom budgets to events, though the specific events that they may want to associate with is decided as the year goes by.

While this is good news, the events business in Oman faces a number of challenges. One, the market is fragmented between publication backed media houses, which use events to bolster their brands, standalone event companies and mom and pop shops. This fragmentation leads to varying quality levels. Second, enhanced competition has led to price undercutting and a compromise on quality. Says Sukaina, “I get calls from clients saying we are more expensive, but we never scale down or compromise on quality.” Thirdly, the industry is feeling the impact of the oil price slide as big government entities have cut down on spends and there is some anxiety on the shape of things to come in 2016.

“People nowadays don’t read newspapers and magazines. Given this changing scenario, events, radio and social media are emerging as strong advertising mediums.” – Sukaina Haider

Lack of creativity

The increasing importance of digital and social, along with the growth of radio and outdoors, has made Oman a more mature market in terms of advertising mediums and choices. This is impacting the way clients think and execute their advertising and marketing. “In the Sultanate, we can see the advertising and media space experiencing steady growth as more companies and organisations are realising the importance of having an integrated approach towards advertising,” says Mohammad Al Farei of Zeenah. “So it’s not about designing a cool looking print ad and booking the media space, it’s about starting with a clearly defined strategy and messaging framework that can be employed and leveraged across multiple media platforms and channels.”

Clients and the media have their own reservations about agencies and the quality of work. “Creative ideas that have an Omani flavour is a challenge while dealing with agencies. Out-of-the-box creativity is missing,” says Hussain Al Lawati of Omasco.

But Bank Nizwa’s Wisam Al Said adds: “I feel that agencies are still centred around thinking in the English language, while the audience is looking for more Arabic content. So you may come up with a great headline in English, but when it gets translated into Arabic, it just does not work.” The media has its own set of woes against agencies. “Agencies are doing well when it comes to client servicing, but they are not growing the market,” says Ahmed Al Zadjali of Muscat Media Group.

Agencies on their part cite their own set of constraints. “With margins going down, hiring talent has become a problem. Historically, India was a market from which people used to be recruited, but now with the business growing there, it has become very difficult to source talent from there,” says Najeeb Mohamed of FP7. “The Lebanese and Syrians prefer to work in Dubai because of lifestyle choices.”

As a result, agencies are left to choose from the local resource pool. Unfortunately, there is no single school in Oman that teaches mass communication or advertising. Given the dynamics of the market, there is a vital need for specialised education in this field.

Looking ahead

While there is a lot of excitement around digital and social media, this needs to be judged against existing market realities. The digital space is moving fast, but it still has a long way to go compared with more developed parts of the world in terms of platforms, understanding, speeds and usage. But what cannot be denied is the explosion in the use of smartphones for access to news, information and social media. In light of this, it will be interesting to see where we are a year from now and whether or not the print media sector has made a successful transition to mobile platforms.

But the good part is that a large part of the population is young, so the next five to seven years will see a very different media landscape, which will force companies, agencies and the media to change. And that is surely a step in the right direction.

Disclaimer

This article has been collated from IPSOS-STAT data and our informed deductions and analysis. Despite such a fundamentally strong pool of empirical evidence we would like readers, advertisers, agencies and publishers to use the inferences in this article as a broad guideline, rather than an absolute given. The supporting data used in this article is based on advertising card rates given by companies. As a standard operating practice, media houses offer discounts ranging anywhere between 30 to 50 percent on these rates and readers can arrive at more realistic figures by doing a back of the envelope calculation.